When Favourable Conditions Create Outliers — A Cohort Story

Educational narrative — not typical, not a projection.

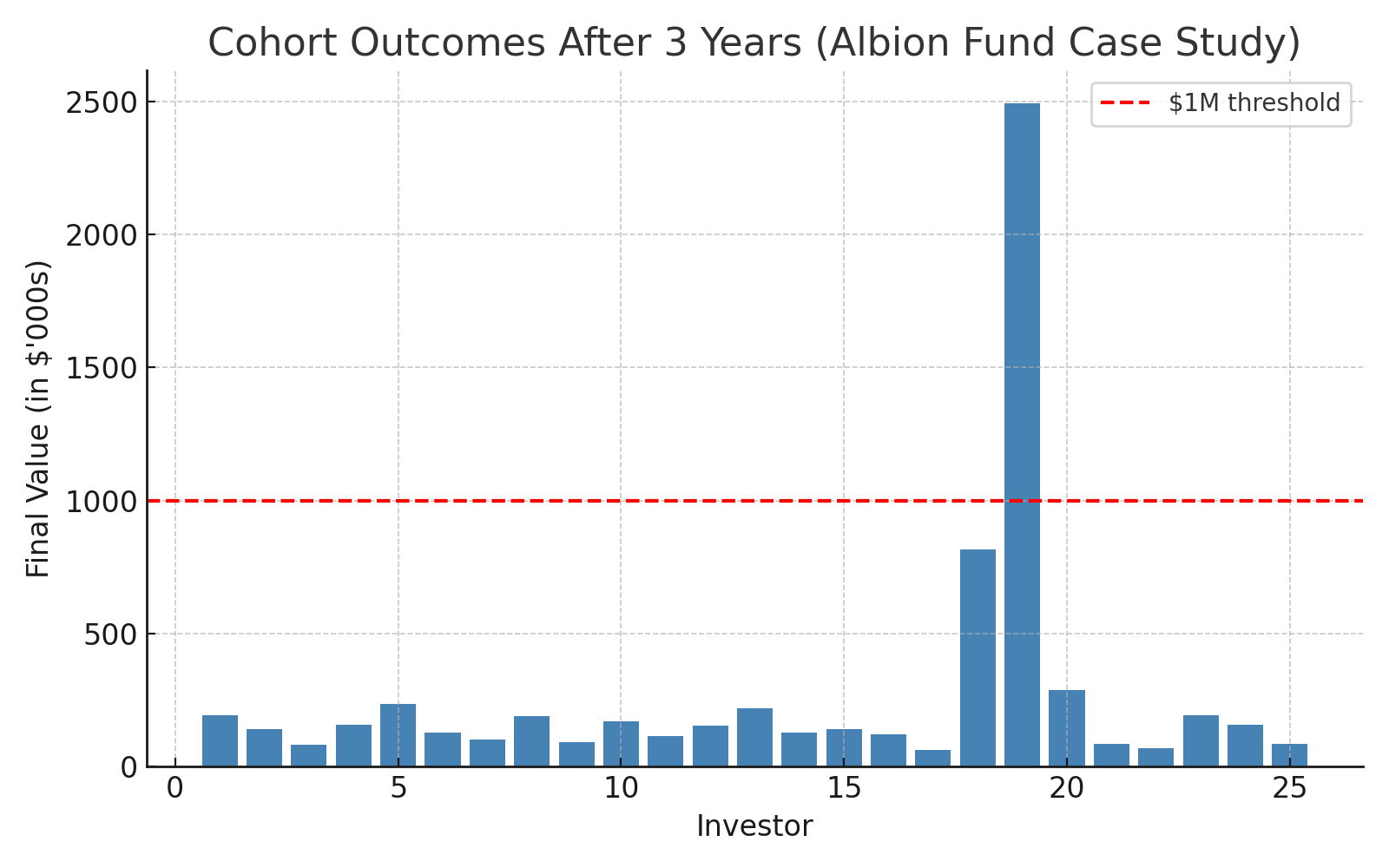

Our core strategy targets steady, transparent returns of 8–12% per annum from rental income. However, markets occasionally produce exceptional outcomes. Three years ago, a £40,000 (~$50,000) stake in an asset near a planned infrastructure corridor benefited from government announcements and rezoning tailwinds. Valuations in that sub‑market rose rapidly and disposals realised outsized gains, taking the stake to a value in excess of $1,000,000 within three years.

We classify this as a rare, external‑factor outcome. It is not the norm, nor is it guaranteed. It demonstrates how disciplined underwriting can sometimes intersect with favourable policy decisions to create extraordinary results.

What Happened

- Multiple investors (>£40k each) participated in assets within the same corridor.

- Government infrastructure announcements and rezoning accelerated demand.

- Rents and valuations lifted quickly; opportunistic disposals locked in gains.

- Outcomes varied by ticket size and timing; a subset exceeded $1,000,000.

Figure: Distribution of investor outcomes (3-year period). Only a subset exceeded the $1,000,000 threshold; results varied by ticket size and timing.

Distribution of investor outcomes over 3 years, highlighting rare $1M+ cases.

Past performance is not indicative of future results. Capital at risk.